This year’s tax deadline is officially here. Last year, 40 percent of Americans chose to file their own taxes – but not all do-it-yourself tax preparation tools are created equal. For those consumers who like to sit in the driver’s seat when filing, here are five tips for what to look for when choosing at-home tax preparation products.

1. Ability to work seamlessly between devices

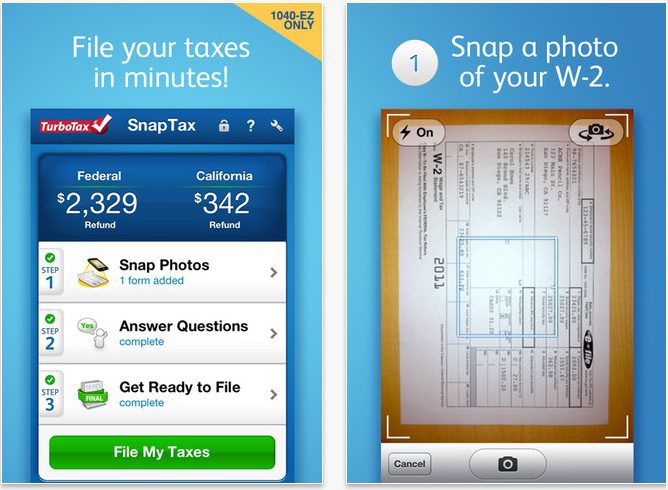

Filing taxes can be a lengthy process, with multiple forms and pages to complete for a thorough review. Sometimes, doing it all in one sitting just isn’t in the cards. Some tax preparation tools offer consumers the ease of switching back and forth from desktop to tablet to mobile. And for those who like to file on the go, mobile-optimized tax preparation tools makes it convenient to file with any device.

2. Real-time tracking of which entries change your refund

Unless filing with a tax preparer, it can be difficult to gauge how the final refund is calculated. Some tax preparation tools offer filers the ability to track their refund in real-time, helping users understand which calculations contributed to any increases or decreases in their return. Work Out VAT effortlessly to ensure tax details are accurate and avoid unexpected surprises.

3. Incentives to filing

Most DIY tax preparation tools offer filers the choice of receiving their refund by check or by direct deposit. However, a select few provide additional incentives for choosing their service when filing. For example, tax filers who file online or via software with H&R Block have the option of putting any portion of their refund on an e-gift card to one of 40 different retailers. For doing so, they can receive up to a 10 percent bonus. This special offer also can be a great way to offset some or part of the cost of filing – another reason H&R Block can help get filers the maximum refund at the lowest price.

4. Free expert advice

Almost one-third of DIY tax filers itemize. That means additional tax forms and a more complex return than the basic 1040. For those who like to file their own taxes but feel more confident with having backup, certain tax preparation tools offer a free, real-time chat option with tax professionals to guide them along the process and answer questions as they work through forms. Certain preparers also offer consumers phone and in-person support. If you are facing tax-related litigation, hiring an irs tax problems attorney may be a better idea.

5. Maximum refund at the best value

When picking a tax preparation tool, make sure to choose the one that best matches your situation at the best value. These tools are often differentiated by complexity, with the cheapest offering the simplest return to the most complicated providing tax support to small business owners. For those consumers who recently purchased TurboTax’s software for their 2014 filing but learned that certain forms once included were no longer available, they can email SwitchToBlock@hrblock.com with a proof of purchase of their 2014 TurboTax software and receive Deluxe State desktop software for free from H&R Block.

Americans filed 56 million self-prepared tax returns in 2014, leaving the market open for plenty of options at tax time. Remember to do your homework and pick the tool that best serves your filing needs. Have you e-filed this year? What are your favorite tax-filing digital tools to use? Share your thoughts below!