As if the fiasco that was the supposed BBM launch that was supposed to happen this past weekend (we were excited for it), the company known as Blackberry may have just found a company to buy them out. The Canadian investment company, Fairfax Financial, lead the consortium of investors and who is also the company’s largest shareholder leads the charge. Blackberry just signed a letter of intent agreement for a sale as they have been looking for a buyout offer since last month.

With the deal pending on a November 4th approval, this would bring the company back to being a private company. The deal is valued at $4.7 billion at $9 per share as BB can still shop around for other potential buyers before the deal is done. Of course, they would still be subjected to a termination fee if they find one.

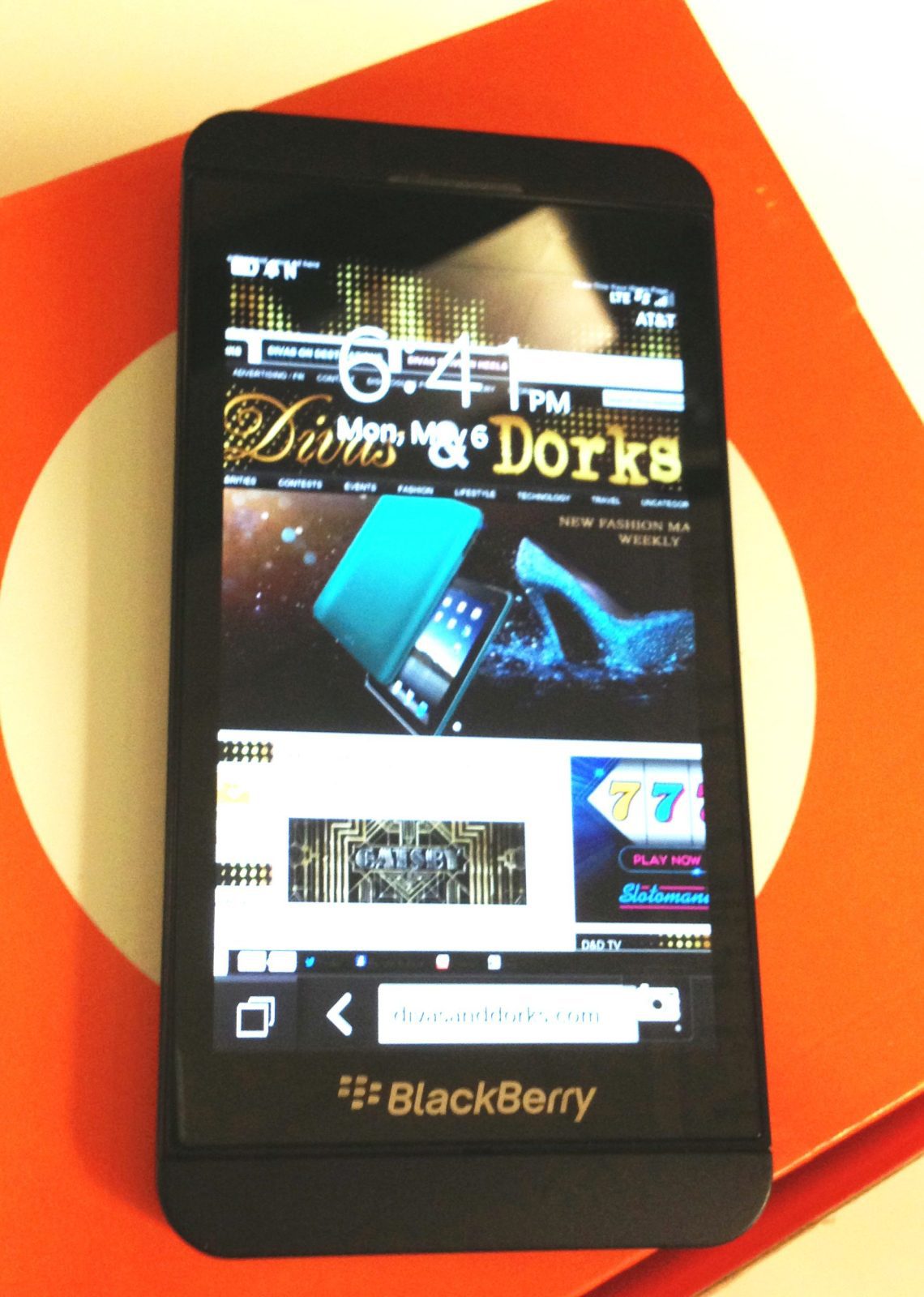

If this goes through, not sure what this means for the company’s future. They could sell BBM and its patents for parts to its competitors or try again on a smaller scale. Only time can tell. It seems that this started taking place soon after Q1 and the release of BB10. What changes do you hope the buyout brings?

- BlackBerry shareholders would receive U.S. $9 per share in cash

- Transaction valued at approximately U.S. $4.7 billion

- Consortium permitted 6 weeks to conduct due diligence

- BlackBerry entitled to go-shop during due diligence period, subject to payment of a termination fee in the event alternative offer accepted

Waterloo, ON – BlackBerry Limited (NASDAQ:BBRY; TSX:BB) today announced it has signed a letter of intent agreement (“LOI”) under which a consortium to be led by Fairfax Financial Holdings Limited (“Fairfax”) has offered to acquire the company subject to due diligence.

The letter of intent contemplates a transaction in which BlackBerry shareholders would receive U.S. $9 in cash for each share of BlackBerry share they hold, in a transaction valued at approximately U.S. $4.7 billion. The consortium would acquire for cash all of the outstanding shares of BlackBerry not held by Fairfax. Fairfax, which owns approximately 10 percent of BlackBerry’s common shares, intends to contribute the shares of BlackBerry it currently holds into the transaction.

The BlackBerry Board of Directors, acting on the recommendation of a special committee of the board of directors (the “Special Committee”), approved the terms of the LOI under which the consortium, which is seeking financing from BofA Merrill Lynch and BMO Capital Markets, would acquire BlackBerry and take the company private subject to a number of conditions, including due diligence, negotiation and execution of a definitive agreement (the “Definitive Agreement”) and customary regulatory approvals.

The Special Committee, chaired by Director Tim Dattels, was formed in August 2013 to review strategic alternatives for the company. J.P. Morgan and Perella Weinberg are acting as financial advisors and Skadden, Arps, Slate, Meagher & Flom LLP and Torys LLP are acting as legal advisors.

Diligence is expected to be complete by November 4, 2013 (“Diligence Period”). The parties’ intention is to negotiate and execute a definitive transaction agreement by such date. During such period, BlackBerry is permitted to actively solicit, receive, evaluate and potentially enter into negotiations with parties that offer alternative proposals (“Alternative Transactions”).

If (A) during the Diligence Period (i) BlackBerry enters into any letter of intent or definitive agreement providing for an Alternative Transaction, (ii) BlackBerry ceases to negotiate

with the consortium in good faith with a view to entering into the Definitive Agreement by the end of the Diligence Period, or (iii) an Alternative Transaction is publicly proposed or publicly announced and is consummated within 6 months following the end of the Diligence Period, or (B) during the 3 month period following the end of the Diligence Period, BlackBerry enters into any agreement providing for an Alternative Transaction with a person with whom discussions were held before or during the Diligence Period, then BlackBerry shall pay Fairfax a fee of U.S. $0.30 per BlackBerry share, provided, however, that no such fee shall be payable if the consortium shall have reduced the price offered below U.S. $9.00 per share without the approval of the board of directors of BlackBerry. In the event that a definitive agreement is signed with Fairfax the termination fee will increase to U.S. $ 0.50 per share.

Barbara Stymiest, Chair of BlackBerry’s Board of Directors, said: “The Special Committee is seeking the best available outcome for the Company’s constituents, including for shareholders. Importantly, the go-shop process provides an opportunity to determine if there are alternatives superior to the present proposal from the Fairfax consortium.”

Prem Watsa, Chairman and CEO of Fairfax, said: “We believe this transaction will open an exciting new private chapter for BlackBerry, its customers, carriers and employees. We can deliver immediate value to shareholders, while we continue the execution of a long-term strategy in a private company with a focus on delivering superior and secure enterprise solutions to BlackBerry customers around the world.”

In addition to the consortium and its lenders being satisfied with all aspects of the due diligence to be carried out by them during the Diligence Period and the negotiation and execution of a binding definitive agreement approved by the board of BlackBerry, completion of the transaction will be subject to other customary conditions, including receipt of required regulatory approvals. There can be no assurance that due diligence will be satisfactory, that financing will be obtained, that a definitive agreement will be entered into or that the transaction will be consummated.

BDT & Company, LLC, BofA Merrill Lynch and BMO Capital Markets are acting as financial advisors, and Shearman & Sterling LLP and McCarthy Tétrault LLP are acting as legal advisors to Fairfax in connection with the transaction.